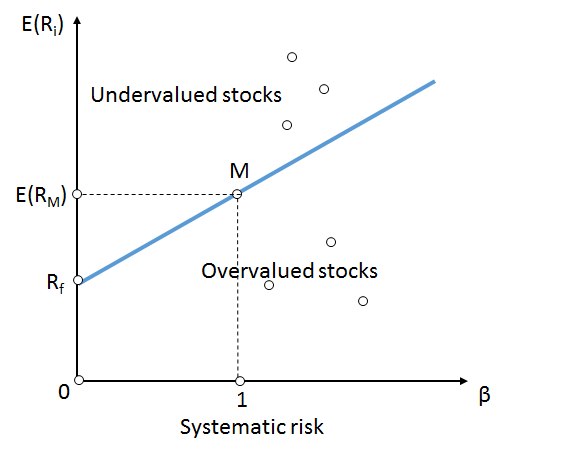

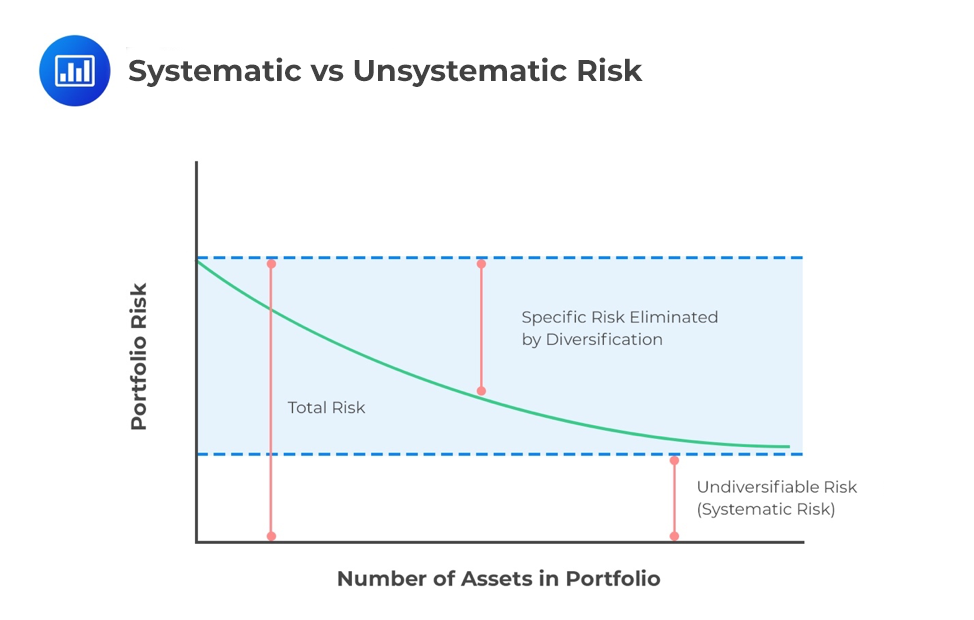

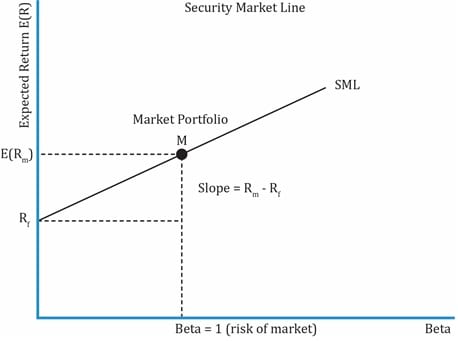

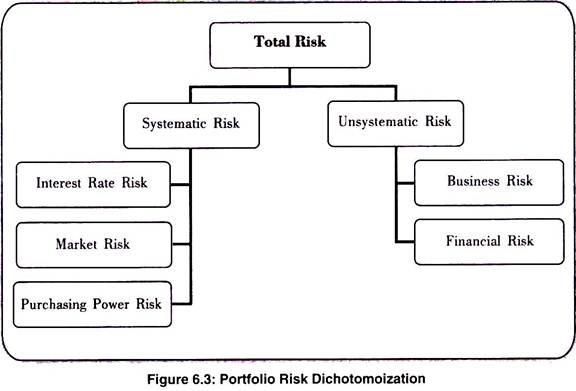

The Security Market Line, Summary and Conclusions, Selected References - Portfolio Theory & Financial Analyses

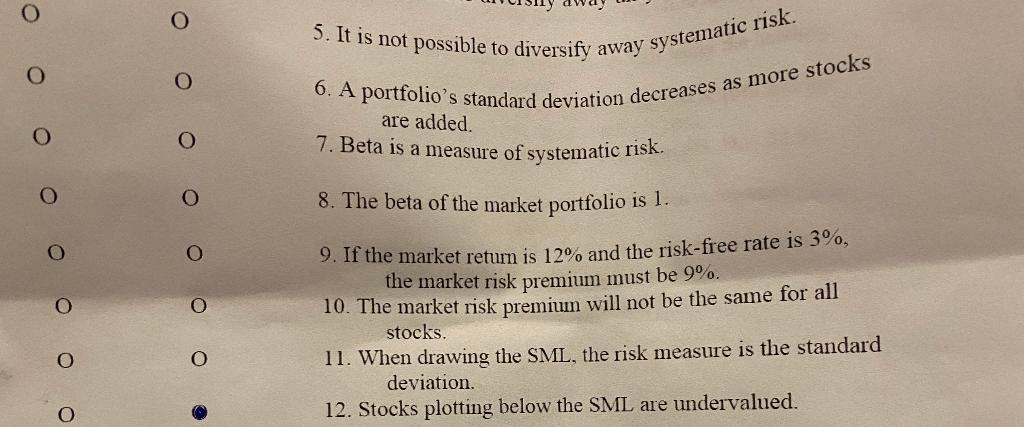

Explain, and graphically depict, how Security Market Line (SML) is different from Capital Market Line (CML). Identify and discuss the importance of minimum variance portfolios. Why might the CAPM equa | Study.com

/CapitalAssetPricingModelCAPM1_2-e6be6eb7968d4719872fe0bcdc9b8685.png)